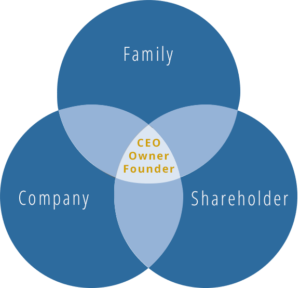

Family businesses differ from other organizations – just as entrepreneurial families also differ from other families: It is not only a company that has to be managed but at the same time a family and a circle of shareholders – three very different systems that are continuously developing and whose complexity grows.

Family businesses – a special type of organization

Management is thus confronted with the task of balancing three complex, growing systems and aligning their needs.

The particular challenge to which those involved are exposed lies in the different logics of family, company and shareholder groups, which place very disparate demands. This dilemma is then often experienced by managers as a paradox.

Uniting three systems with different logics

Resources and burdens - special challenges in family businesses

Over 90% of the companies in Germany can be described as family businesses and are considered the “backbone of the German economy”. They are viewed as the guarantors of a real economic orientation that has not lost sight of people, that combines employee orientation and location loyalty with high performance and modern forms of management – family businesses are “the human face of the economy”.

Due to their special constellation of three systems with completely different logics, family businesses face special challenges compared to other types of organizations. In addition to the company, the family and the circle of shareholders with all their different interests and needs have to be reconciled and managed – at the same time, these systems are constantly evolving and so does their complexity. An owner family with four members, for example, is easier to keep track of than a circle of shareholders with 35 members or even 120 or more. If the balancing act between these three systems succeeds, though, this type of organization enjoys enormous competitive advantages over other types of organization – the owner family and the company continue to develop constructively together.

Our solution portfolio

We can draw on decades of experience in supporting family businesses facing significant transitions.

Our expertise enables us to develop new structures and organizational routines in cooperation with our clients around the particular conflict situations of a family business, to concretize the associated functional challenges and to translate these into requirement profiles for key players.